HIVE Blockchain Provides March 2022 Production and Intel Update

This news release constitutes a "designated news release" for the purposes of the Company's prospectus supplement dated February 2, 2021 to its amended and restated short form base shelf prospectus dated January 4, 2022.

Vancouver, Canada – HIVE Blockchain Technologies Ltd. (TSX.V:HIVE) (Nasdaq:HIVE) (FSE:HBF) (the “Company” or “HIVE”) is pleased to announce the production figures from the Company’s global Bitcoin and Ethereum mining operations for the month of March 2022, with a BTC HODL balance of 2,568 Bitcoin and 16,196 Ethereum as of April 3, 2022. In addition to this the Company is pleased to announce two milestone accomplishments of reaching 2 Exahash of Bitcoin mining and 6 Terahash of Ethereum mining this month

March 2022 Production Figures

HIVE is pleased to announce its March 2022 production figures and mining capacity:

- 278.6 BTC Produced

- 2.0 Exahash of Bitcoin mining capacity

- 2,459 ETH Produced*

- 4.58 Terahash of Ethereum mining capacity at beginning of March

- Increased to 6.1 Terahash of Ethereum mining capacity at end of March

*The Company’s production of ETH from GPU mining (including selective optimizations of GPU hashrate) has yielded a total ETH production of 2,549 ETH.

Frank Holmes, Executive Chairman of HIVE stated “We are very pleased to report HIVE has continued its extremely strong momentum in expanding our hashing power, notably our Ethereum mining hash power grew by 33% this month. In March we produced an average of 9.0 BTC per day, and we are pleased to note that as of today, we are producing approximately 9.0 BTC a day even after the recent difficulty increase of 4%. Our Bitcoin hashing power increased in March and at the calendar month-end our hashrate was 2.0 Exahash, which translated into a 6% increase in BTC mining on a month over month basis, while BTC prices corrected.”

Aydin Kilic, President & COO of HIVE noted “We continue to strive for operational excellence, ensuring that as we scale our hashrate as a company we also optimize our uptime, to ensure ideal Bitcoin and Ethereum output figures.” Mr. Kilic continued, “We also would like to provide an update on the BTC and ETH equivalency, where one can equate value of the coins produced daily. As such the ETH that HIVE produced during the month of March, equated daily, is approximately equal to a monthly total of 168.8 BTC, which we refer to as Bitcoin equivalent or BTC equivalent. This is in addition to the 278.6 BTC produced from our Bitcoin mining operations during March, for a total of 447.4 Bitcoin equivalent”

The Company’s total Bitcoin equivalent production in March 2022 was:

- 447.4 BTC Equivalent Produced

- 14.4 BTC Equivalent produced per day on average

- 3.3 Exahash of BTC Equivalent Hashrate (BTC hashrate plus equivalent ETH Hashrate as of March 31, 2022)

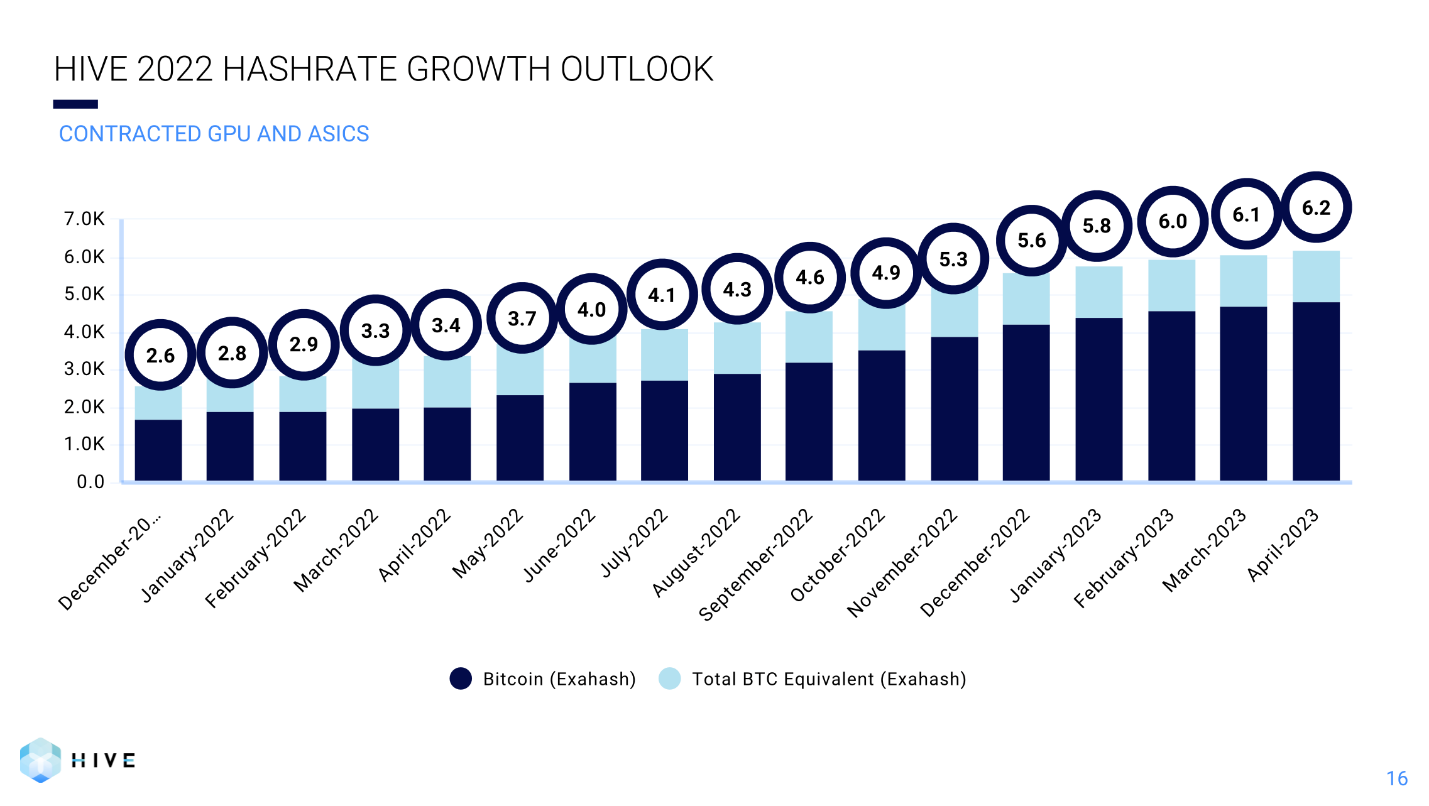

1 Year Ahead Hashrate Growth Outlook

HIVE is pleased to update the market on the Company’s growth plans for the year ahead, as a result of strategic initiatives to secure ASIC and GPU hardware. The graph below presents the hashrate for all contracted ASIC and GPU hardware (with deposits in place), with the dark blue bars representing BTC hashrate, and the light blue bars representing the additional BTC equivalent hashrate from the ETH GPU hashrate. The numbers at the top are the combined total BTC equivalent hashrate expressed in Exahash. The Company will be at 6.2 Exahash of BTC equivalent hashrate in one year, up from 3.3 Exahash of BTC equivalent hashrate today.

Ethereum HODL to Fund Intel New Chips to Mine BTC

Over the past year our Ethereum HODL position outperformed our Bitcoin HODL. ETH is much more volatile than BTC and once again we have used the volatility to generate capital to expand our operations. We have sold down our ETH holdings to fund our Intel strategic relationship and the building of our rigs. We are very thrilled about the Intel deal for several reasons and due to the greater volatility of ETH we have traded out approximately 10,000 ETH coins to fund the expansion in our BTC channel. Further we have expanded our daily ETH production to replace coins we have sold. Our long-term strategy is grow our BTC footprint while using our ETH to help with this ambition. Our ETH production is allowing us to generate the highest margins from proof of work in the business. We are not concerned about the 6 year narrative that ETH will become only proof of stake in the immediate future, as evidenced by the robust and secure proof of work consensus mechanism has helped ETH process more transactions in USD volume at $11.4 trillion US, where Visa has done $10.4 trillion US in 2021. Our strategy to mine both BTC and ETH has allowed HIVE to generate some of the highest returns on invested capital for our shareholders while expanding our revenue and coin production.

Intel Update

Recently Intel has published more specifics on introduction of the Intel Blockscale ASIC, a game changing event for BTC miners. Intel has only made this chip available to select customers, of which Hive Blockchain is one of four customers globally. The Intel Blockscale will advance energy efficient hashing for proof of work consensus using green energy. Further their US designed high performing chips are up to 26 J/TH power efficiency at a very competitive and attractive price that fits into our strategy to generate high returns on invested capital for our shareholders. Hive Blockchain shares in the sustainability goals that are important to both Intel and ESG focused investors.

Network Mining Difficulty

The Bitcoin network difficulty increased as much as 4% and similarly the Ethereum network difficulty increased as much as 2% during the month of March. These factors impact our gross profit margins.

About HIVE Blockchain Technologies Ltd.

HIVE Blockchain Technologies Ltd. went public in 2017 as the first cryptocurrency mining company with a green energy and ESG strategy.

HIVE is a growth-oriented technology stock in the emergent blockchain industry. As a company whose shares trade on a major stock exchange, we are building a bridge between the digital currency and blockchain sector and traditional capital markets. HIVE owns state-of-the-art, green energy-powered data centre facilities in Canada, Sweden, and Iceland, where we source only green energy to mine on the cloud and HODL both Ethereum and Bitcoin. Since the beginning of 2021, HIVE has held in secure storage the majority of its ETH and BTC coin mining rewards. Our shares provide investors with exposure to the operating margins of digital currency mining, as well as a portfolio of cryptocurrencies such as ETH and BTC. Because HIVE also owns hard assets such as data centers and advanced multi-use servers, we believe our shares offer investors an attractive way to gain exposure to the cryptocurrency space.

We encourage you to visit HIVE’s YouTube channel here to learn more about HIVE.

For more information and to register to HIVE’s mailing list, please visit www.HIVEblockchain.com. Follow @HIVEblockchain on Twitter and subscribe to HIVE’s YouTube channel.

On Behalf of HIVE Blockchain Technologies Ltd.

“Frank Holmes”

Executive Chairman

For further information please contact:

Frank Holmes

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

Forward-Looking Information

Except for the statements of historical fact, this news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates and projections as at the date of this news release. “Forward-looking information” in this news release includes, but is not limited to, business goals and objectives of the Company; and other forward-looking information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, the volatility of the digital currency market; the Company’s ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company’s operations; the volatility of digital currency prices; continued effects of the COVID-19 pandemic may have a material adverse effect on the Company’s performance as supply chains are disrupted and prevent the Company from carrying out its expansion plans or operating its assets; and other related risks as more fully set out in the registration statement of Company and other documents disclosed under the Company’s filings at www.sec.gov/EDGAR and www.sedar.com.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company’s objectives, goals or future plans, the timing thereof and related matters. The Company has also assumed that no significant events occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.