Zug, Switzerland and Vancouver, Canada – HIVE Blockchain Technologies Ltd. (TSX.V:HIVE) (OTCQX:HVBTF) (the “Company” or “HIVE”) announces its results for the second quarter ended September 30, 2019 (all amounts in US dollars, unless otherwise indicated).

“I am pleased to report a healthy second fiscal quarter of positive free cash flow contributing to an already strong balance sheet and continued progress in restructuring our operations to ensure sustainable future profitability,” said Frank Holmes, Interim Executive Chairman of HIVE.

“Since we assumed control in the latter part of 2018, the current management team’s focus has been on ensuring transparency and accountability and assuming direct control of our operations to improve operational efficiency. We have changed service providers, assumed direct control of our supply chain in Sweden, and initiated reviews of the profitability of our various business units.

“I am particularly pleased with the improvements we have seen in our GPU Ethereum mining operational efficiency. During the second fiscal quarter, we unwound our previous service provider agreement in Sweden and assumed full control of our supply chain in that jurisdiction. This transition, which was completed in November, is anticipated to result in an approximately 25% reduction in our operating and maintenance costs, notably through direct relationships with local energy suppliers.

“We are now focused on achieving a similar result for our smaller Ethereum mining facility in Iceland, either by improving profitability or relocating equipment there to a lower cost jurisdiction as Iceland has become less price competitive.

“During the quarter, our cloud mining operations for Bitcoin benefited from a healthy coin price in the summer months but market conditions worsened significantly into the fall. The price of Bitcoin declined while the difficulty in mining Bitcoin increased dramatically reaching a record high. As these operations operate on a fixed cost basis, we have prudently decided to suspend 200 Petahashes of our cloud mining capacity as the current quarter has become unprofitable for mining. We are currently reviewing various factors including market conditions and the anticipated impact on legacy ASIC miners from the halving of Bitcoin rewards expected to occur in May 2020, to determine our best path forward for this equipment.

“We currently have a healthy net cash balance and significant digital assets portfolio. We are evaluating a pipeline of potential investments including M&A to determine the best opportunities to generate shareholder returns. Subsequent to quarter end, we continued to build our brain trust through the appointment of Dave Perrill, the CEO of rapidly growing data center company Compute North, to our board of directors. Dave will help us execute this next stage of our growth strategy.

“The cryptocurrency market has continued to remain volatile, and the share prices of digital currency miners in general has underperformed the actual coins,” Mr. Holmes concluded. “We have not been immune to this as our share price, which previously was highly correlated to the performance of cryptocurrencies, has decoupled from them for the past six months as large, early investors in HIVE have pared down positions. While we cannot control such external impacts, we continue to remain focused on improving the profitability of our operations and are hopeful that our share price will ultimately reflect improving fundamentals.”

Q2 F2020 Highlights

- Generated record income from digital currency mining of $12.0 million

- Generated gross mining margin of $(0.6) million from mining of digital currencies, or approximately $5.5 million, excluding certain non-recurring charges including a value added tax provision in Switzerland related to historical periods, upfront energy costs paid during the quarter in Sweden for which the Company anticipates receiving energy rebates in the future, as well as some overlapping service provider costs the Company paid related to its transition to its new service provider, Blockbase, from its original provider Genesis

- Increased mining output of newly minted digital currencies:

- 586 Bitcoin

- 20,649 Ethereum

- 32,692 Ethereum Classic

- Incurred a net loss of $11.5 million for the period, reflecting the non-recurring charges impacting gross mining margin as well as $6.1 million in non-cash expenses, $2.1 million in recorded foreign exchange loss, and $1.4 million recorded loss on sale of digital currencies and investments reflecting a decline in certain coin pricing

- Generated $0.3 million in cash flow from operations

- Increased net cash less loans payables to $5.3 million, with digital currencies assets at $7.2 million, as at September 30, 2019

Financial Review

For the quarter ended September 30, 2019, income was $12.0 million, an increase of approximately 84% from the same period in the prior year. Second quarter income from digital currency mining was produced from an average of 24.2 MW of GPU production capacity, and 300 PH of Cloud Mining capacity, as at September 30, 2019.

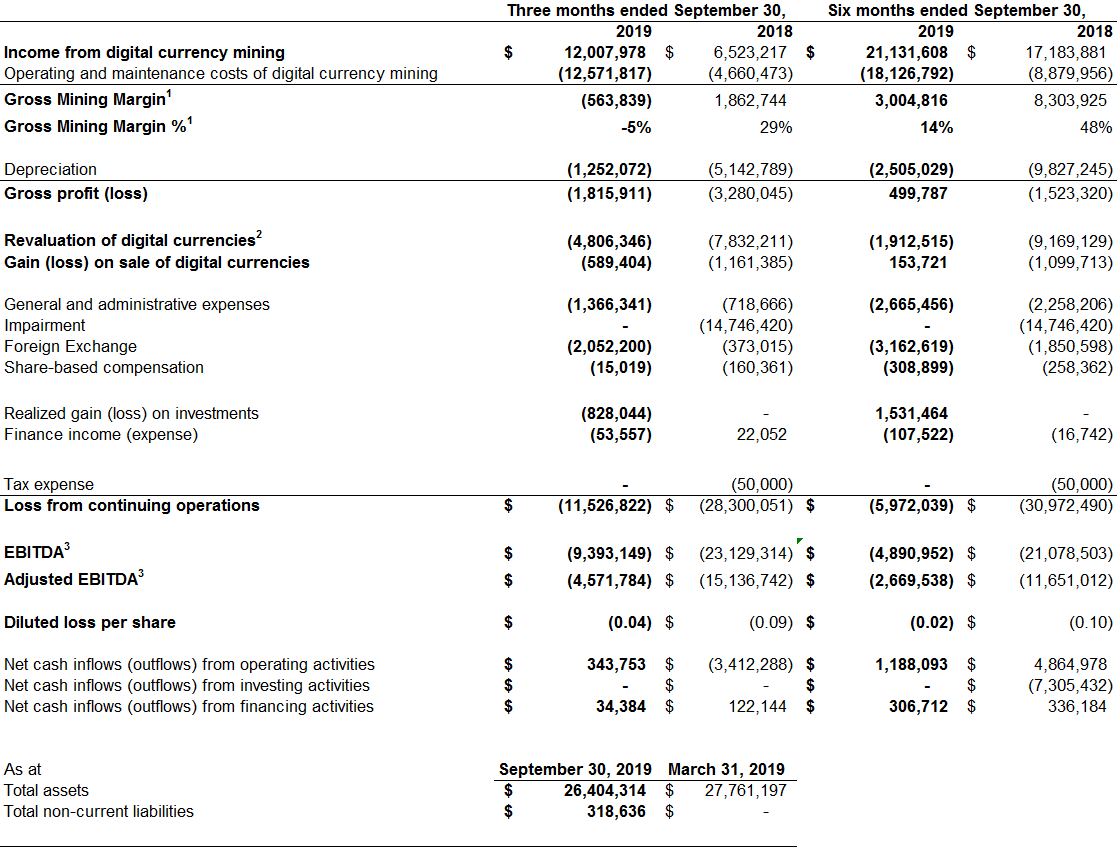

- Gross mining margin equates to income from digital mining less operating and maintenance costs and is a non-IFRS measure; see Non-IFRS Measures in MD&A for reconciliation

- Revaluation is calculated as the change in value (gain or loss) on the coin inventory. When coins are sold, the net difference between the proceeds and the carrying value of the digital currency (including the revaluation), is recorded as a gain (loss) on the sale of digital currencies

- EBITDA and Adjusted EBITDA are non-IFRS measures; see Non-IFRS Measures in MD&A for reconciliation

Financial Statements and MD&A

The Company’s Condensed Interim Consolidated Financial Statements and Management’s Discussion and Analysis (MD&A) thereon for the three and six months ended September 30, 2019 will be accessible on SEDAR at www.sedar.com under HIVE’s profile and on the Company’s website at www.HIVEblockchain.com.

Webcast Details

Management will host a webcast on Monday, December 2, 2019 at 9:00 am Eastern Time to discuss the Company’s financial results. Presenting on the webcast will be Frank Holmes, Interim Executive Chairman and Darcy Daubaras, Chief Financial Officer. IMPORTANT- Click here to register for the webcast.

About HIVE Blockchain Technologies Ltd.

HIVE Blockchain Technologies Ltd. is a growth oriented, TSX.V-listed company building a bridge from the blockchain sector to traditional capital markets. HIVE owns state-of-the-art GPU-based digital currency mining facilities in Iceland and Sweden, which produce newly minted digital currencies like Ethereum continuously as well as cloud-based ASIC-based capacity which produces newly minted digital currencies like Bitcoin. Our deployments provide shareholders with exposure to the operating margins of digital currency mining as well as a growing portfolio of crypto-coins.

For more information and to register to HIVE’s mailing list, please visit www.HIVEblockchain.com. Follow @HIVEblockchain on Twitter and subscribe to HIVE’s YouTube channel.

On Behalf of HIVE Blockchain Technologies Ltd.

“Frank Holmes”

Interim Executive Chairman

For further information please contact:

Frank Holmes

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

Except for the statements of historical fact, this news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates and projections as at the date of this news release. “Forward-looking information” in this news release includes information about restructuring of the Company’s operations and sustainable future profitability; review of certain business unit profitability; improvements in GPU Ethereum mining operational efficiency; the Company’s estimated 25% reduction in operating and maintenance costs in Sweden; potential restructuring at the Company’s Iceland facility (either through improving profitability or relocating equipment located in Iceland); the review of conditions for ASIC mining (and ASIC equipment use going forward), including the expected impact of the halving of Bitcoin awards expected in May 2020; potential investments (including M&A) by the Company; shareholder returns; the impact of early investors in HIVE paring down share positions; the potential for the Company’s long term growth; the business goals and objectives of the Company, and other forward-looking information includes but is not limited to information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, the efficiencies obtained through restructurings may not lead to operational advantages or profitability; the ongoing partnership with Genesis and any of the third parties for which the Company relies for its operations; early investors may continue to reduce their share positions in HIVE; the digital currency market; the Company’s ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on the Company’s operations; the volatility of digital currency prices; and other related risks as more fully set out in the Filing Statement of the Company dated and other documents disclosed under the Company’s filings at www.sedar.com.

This news release also contains “financial outlook” in the form of gross mining margins, which is intended to provide additional information only and may not be an appropriate or accurate prediction of future performance, and should not be used as such. The gross mining margins disclosed in this news release are based on the assumptions disclosed in this news release and the Company’s Management Discussion and Analysis for the quarter ended September 30, 2019, which assumptions are based upon management’s best estimates but are inherently speculative and there is no guarantee that such assumptions and estimates will prove to be correct.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company’s ability to realize operational efficiencies going forward into profitability; profitable use of the Company’s assets going forward; the Company’s ability to profitably liquidate its digital currency inventory as required; the Company’s ongoing partnership with Genesis and new partnership with Blockbase; historical prices of digital currencies and the ability of the Company to mine digital currencies will be consistent with historical prices; and there will be no regulation or law that will prevent the Company from operating its business. The Company has also assumed that no significant events occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.