HIVE Digital Technologies Announces August 2024 Production of 112 Bitcoin and 1% HODL Growth to 2,567 Bitcoins and Acquires 1,000 Bitmain S21 Pro for Immediate Delivery

Vancouver, Canada – HIVE Digital Technologies Ltd. (TSX.V: HIVE) (Nasdaq: HIVE) (FSE: YO0.F) (the “Company” or “HIVE”) a pioneer in green energy-powered blockchain infrastructure, is pleased to announce its unaudited production results for August 2024. The Company successfully mined 112 Bitcoin, boosting its total Bitcoin holdings by 1%, bringing the balance to 2,567 BTC. HIVE also announced the acquisition of 1,000 Bitmain S21 Pro Antminers for immediate delivery to upgrade its existing suite of machines, enhancing overall mining efficiency and capacity. HIVE maintained an impressive average Bitcoin mining capacity of over 5.0 Exahash per second (“EH/s”) throughout the month, all while continuing its commitment to green energy by primarily sourcing hydroelectricity to power its data centers (all amounts in US dollars, unless otherwise indicated).

August 2024 Highlights:

- Production: Mined 112 Bitcoin in August 2024.

- Mining Capacity Maintained: Concluded the month with a 5.3 EH/s ASIC mining capacity, achieving a blended fleet efficiency of 23 joules per terahash (“J/TH”).

- HODL Position: Increased Bitcoin holdings to 2,567 BTC, reflecting a 1% growth from the previous month.

- Mining Efficiency: Averaged 22.4 Bitcoin per Exahash, ending August with a 5.3 EH/s capacity and a consistent average hashrate of 5.0 EH/s.

- Daily Production: Averaged 3.6 BTC per day, highlighting operational efficiency and robust mining capabilities.

Strategic HODL Increase:

HIVE emphasizes that with a Bitcoin HODL value exceeding $164 million as of August 31, 2024, the Company's enterprise value remains compelling compared to industry peers.

Executive Insights:

Frank Holmes, Executive Chairman, commented, "We remain focused on our strategy of maintaining the lowest G&A expenses per Bitcoin mined, maximizing cash flow return on invested capital, and achieving high revenue per employee while minimizing share dilution. Our disciplined approach, supported by a global team operating across nine time zones, positions HIVE as one of the leanest Bitcoin mining operations with an attractive EV to EBITDA multiple, holding over 2,500 clean and green Bitcoin on our balance sheet."

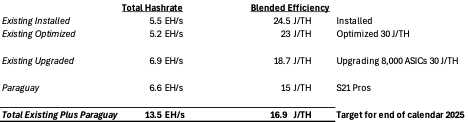

Aydin Kilic, President and CEO added, "Over the past month, we have optimized our fleet's performance, achieving an average hashrate of approximately 5.2 EH/s by fine-tuning the firmware of our 30 J/TH machines, improving their efficiency to 27-28 J/TH. This has led to a global fleet efficiency of approximately 23 J/TH. We plan to continue this optimization over the next nine months, upgrading our remaining 30 J/TH ASICs. This will increase our installed hashrate at existing facilities to 6.9 EH/s with a blended fleet efficiency of 19 TH/s."

He further noted, "To support this strategy, we have acquired 1,000 Bitmain S21 Pro Antminers for immediate delivery to upgrade our existing suite of equipment. Additionally, we have purchased 300 Bitmain S19 XP miners to fully utilize available rack space at our Lachute facility. These machines were purchased and installed in August."

With this monthly rolling upgrade strategy, HIVE's updated target hashrate is projected to reach 13.5 EH/s, with a global blended fleet efficiency of 16.9 J/TH upon the completion of the Paraguay facility. This will be achieved while maintaining our green energy strategy, which prioritizes the use of hydroelectricity to power our data centers.

About HIVE Digital Technologies Ltd.

HIVE Digital Technologies Ltd. went public in 2017 as the first cryptocurrency mining company listed for trading on the TSX Venture Exchange with a focus on sustainable green energy.

HIVE is a growth-oriented technology stock in the emergent blockchain industry. As a company whose shares trade on a major stock exchange, we are building a bridge between the digital currency and blockchain sector and traditional capital markets. HIVE owns and operates state-of-the-art, green energy-powered data centre facilities in Canada, Sweden, and Iceland, where we endeavour to source green energy to mine digital assets such as Bitcoin on the cloud. Since the beginning of 2021, HIVE has held in secure storage the majority of its treasury of BTC derived from mining rewards. Our shares provide investors with exposure to the operating margins of digital currency mining, as well as a portfolio of Bitcoin. Because HIVE also owns hard assets such as data centers and advanced multi-use servers, we believe our shares offer investors an attractive way to gain exposure to the cryptocurrency space.

Environmental Sustainability:

- Green Energy: By sourcing green renewable energy, HIVE is committed to environmental responsibility, positioning itself as a leader in sustainable cryptocurrency mining.

- Competitive Advantage: We believe this environmentally conscious approach sets HIVE apart from competitors and aligns with evolving investor preferences.

Expansion into AI Strategy:

- Diversification: HIVE’s diversification into HPC enables us to support artificial intelligence (AI) using Nvidia GPU chips, showcasing our adaptability and innovation beyond traditional Bitcoin mining.

- Revenue Streams: This strategic move into HPC broadens HIVE’s revenue streams and places it at the forefront of technological advancements in both cryptocurrency and AI industries.

HIVE’s unique value proposition encompasses efficient operations, a proven agile management team, financial strength, environmental sustainability, and innovative expansion strategies. Beyond Bitcoin mining, HIVE is firmly part of the global boom in data center infrastructure, sourcing primarily green renewable energy.

HIVE presents a unique growth opportunity with over 2,500 Bitcoins on its balance sheet and growing revenue from its suite of Nvidia GPU chips powering data services for the AI revolution.

We encourage you to visit HIVE’s YouTube channel here to learn more about HIVE.

For more information and to register to HIVE’s mailing list, please visit www.HIVEdigitaltechnologies.com. Follow @HIVEDigitalTechon Twitter and subscribe to HIVE’s YouTube channel.

On Behalf of HIVE Digital Technologies Ltd.

“Frank Holmes”

Executive Chairman

For further information please contact:

Frank Holmes

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

Forward-Looking Information

Except for the statements of historical fact, this news release contains “forward-looking information” within the meaning of the applicable Canadian and United States securities legislation and regulations that is based on expectations, estimates and projections as at the date of this news release. “Forward-looking information” in this news release includes but is not limited to: business goals and objectives of the Company; the results of operations for August 2024; the acquisition, deployment and optimization of the mining fleet and equipment; the continued viability of its existing Bitcoin mining operations; and other forward-looking information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward looking information include, but are not limited to, the volatility of the digital currency market; the Company’s ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company’s operations; the regulatory environment for cryptocurrency in Canada, the United States and the countries where our mining facilities are located; economic dependence on regulated terms of service and electricity rates; the speculative and competitive nature of the technology sector; dependency on continued growth in blockchain and cryptocurrency usage; lawsuits and other legal proceedings and challenges; government regulations; the global economic climate; dilution; future capital needs and uncertainty of additional financing, capital market conditions in general; risks relating to the strategy of maintaining and increasing Bitcoin holdings and the impact of depreciating Bitcoin prices on working capital; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the effects of product development and need for continued technology change; the ability to maintain reliable and economical sources of power to run its cryptocurrency mining assets; the impact of energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; network security risks; the ability of the Company to maintain properly working systems; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; share dilution resulting from equity issuances; the construction and operation of facilities may not occur as currently planned, or at all; expansion may not materialize as currently anticipated, or at all; the digital currency market; the ability to successfully mine digital currency; revenue may not increase as currently anticipated, or at all; it may not be possible to profitably liquidate the current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on operations; an increase in network difficulty may have a significant negative impact on operations; the volatility of digital currency prices; the anticipated growth and sustainability of electricity for the purposes of cryptocurrency mining in the applicable jurisdictions; the inability to maintain reliable and economical sources of power for the Company to operate cryptocurrency mining assets; the risks of an increase in the Company’s electricity costs, cost of natural gas, changes in currency exchange rates, energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates and the adverse impact on the Company’s profitability; the ability to complete current and future financings, any regulations or laws that will prevent the Company from operating its business; historical prices of digital currencies and the ability to mine digital currencies that will be consistent with historical prices; an inability to predict and counteract the effects of pandemics on the business of the Company, including but not limited to the effects of pandemics on the price of digital currencies, capital market conditions, restriction on labour and international travel and supply chains; and, the adoption or expansion of any regulation or law that will prevent the Company from operating its business, or make it more costly to do so; and other related risks as more fully set out in the Company’s disclosure documents under the Company’s filings at www.sec.gov/EDGAR and www.sedarplus.ca.

The forward-looking information in this news release reflects the Company's current expectations, assumptions, and/or beliefs based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company’s objectives, goals or future plans, the timing thereof and related matters. The Company has also assumed that no significant events occur outside of the Company’s normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance, and accordingly, undue reliance should not be put on such information due to its inherent uncertainty. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, other than as required by law.